However, discounting dividends is of little help for valuing companies that pay no dividends, which includes many firms today. One question that must be asked of any discounted cash-flow model is exactly what kind of cash flows are you going to be discounting? In the old days, investors used something similar to a dividend discount model, which essentially sums up all the future dividend payments a company is expected to make and expresses them in terms of today's pounds. Adding an additional customer doesn't change this key cost.

#DISCOUNT RATE IN DISCOUNTED CASH FLOW SOFTWARE#

Likewise, a software company sees most of its costs in development. Think of eBay ( EBAY ): It can add thousands of customers with only very modest investments to its existing computer systems. As a result, the company's operating profits should grow at a faster rate than revenue. Operating leverage means that as a company grows larger, it is able to spread its fixed costs across a broader base of production. On the other hand, some companies benefit from operating leverage. Chemical companies that are heavily reliant on oil and natural gas, for example, could see profit margins contract if these materials go up in price and they cannot pass these cost increases on to customers. Looking into a company's costs is an obvious first step. For example, if an auto-manufacturer says it will produce fewer cars over the next couple of years, it would be wise to check your revenue growth assumptions for auto parts suppliers.ĭetermining a company's future operating profits entails similar detective work. Paying attention to a firm's suppliers and customers is also important. A company with strong competitive advantages (aka an economic moat) may grow faster than its competitors if it is stealing market share. When predicting a company's revenue growth, it's important to consider a variety of factors, including industry trends, economic data, and a company's competitive advantages. In fact, doing so can often lead you to believe a stock is worth a lot more (or less) than it really is.

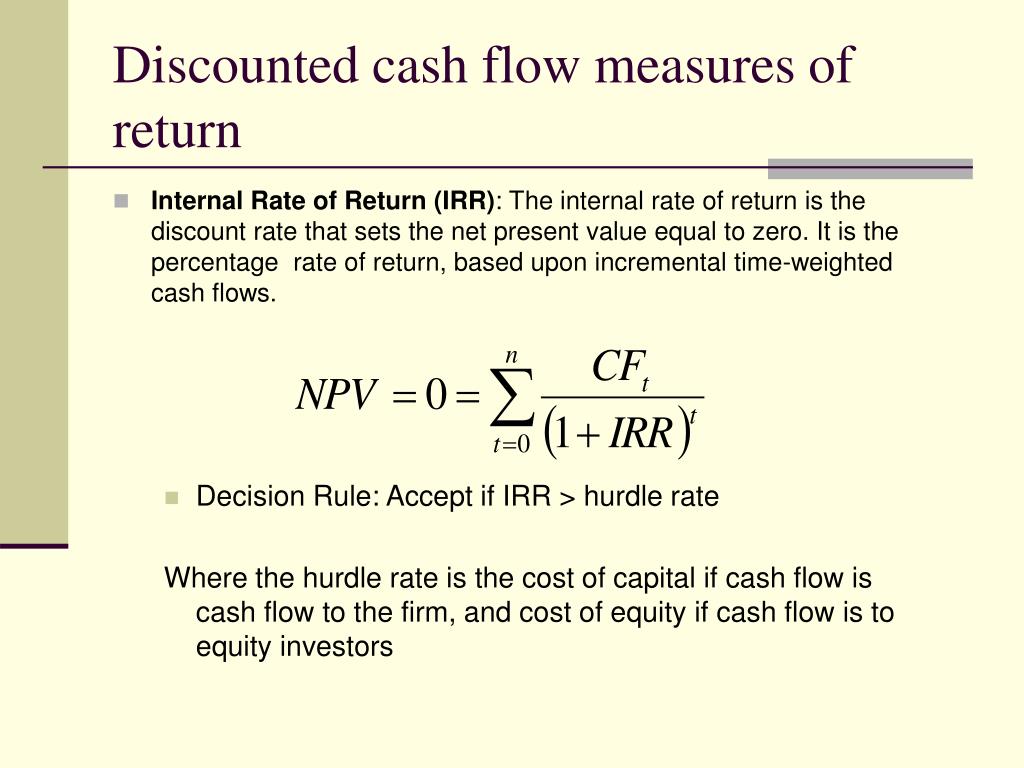

Projecting such variables doesn't involve simply extrapolating present trends into the future. Many variables go into estimating those cash flows, but among the most important are the company's future sales growth and profit margins. The first step to valuing any stock with a DCF model is estimating the future cash flows the underlying company is going to generate. Putting this idea into practice is where the difficulty lies. The main idea behind a DCF model is relatively simple: a stock's worth is equal to the present value of all its estimated future cash flows. Despite their complexity, valuations based on DCF models are much more flexible than any individual ratio, and they allow an investor to incorporate assumptions about such factors as a company's growth prospects, whether its profit margins are likely to expand or contract, and how risky the company is in general. Even so, we at Morningstar use discounted cash flow models to value all the stocks we cover. In fact, it is quite complex, involving all kinds of variables that are themselves tough to estimate. Estimating a stock's fair value, or intrinsic value, is no easy task.

0 kommentar(er)

0 kommentar(er)